How Much Does A Defensive Driving Course Reduce Insurance

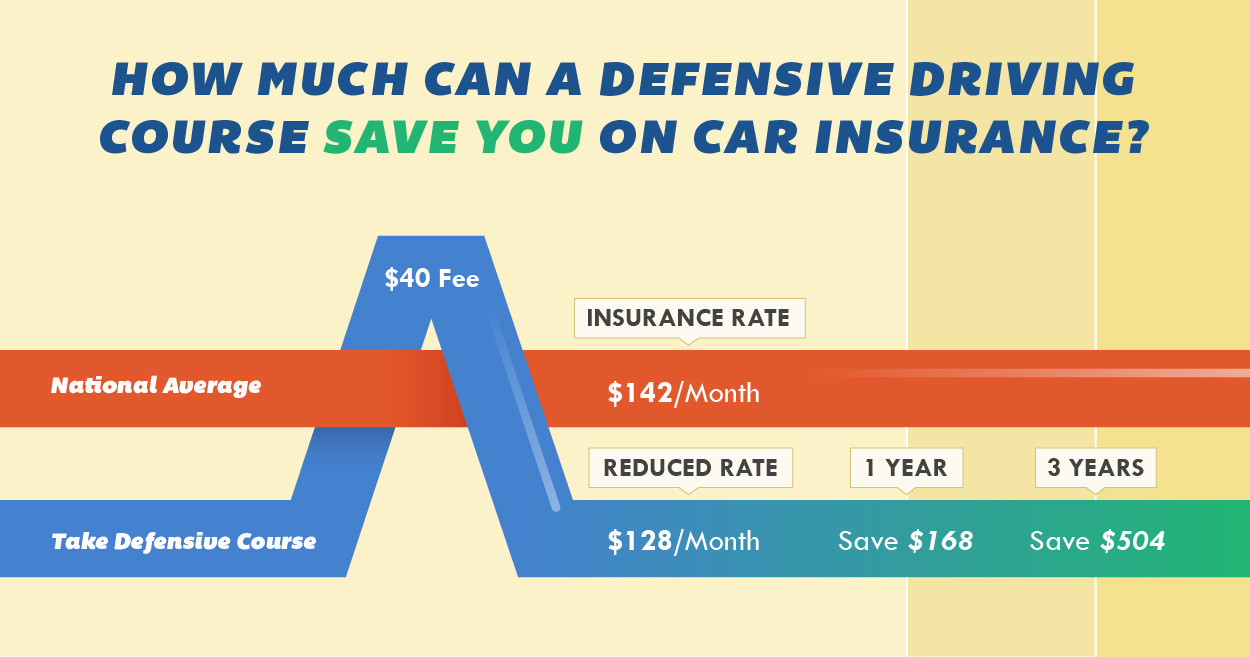

How Much Does A Defensive Driving Course Reduce Insurance - Discounts for defensive driving courses vary from 5%. Many insurance providers consider a defensive driving course to be a driver safety course, and taking them can give you savings ranging from 5% to 20% off your annual auto insurance cost. We work closely with major insurance providers to ensure our course meets their criteria for discounts. Car insurance companies would always like you to be a safer driver. Depending on your auto insurance provider, you may be eligible to take a defensive driving course to earn a safe driver insurance discount. Both online defensive driving course and classroom traffic school will generally cover topics including: Please contact your insurance provider for more information and to check if a discount applies to you. You should also want this for yourself. Driving under the influence is a dangerous and expensive mistake. Some states require insurers to offer a discount for taking a defensive driving course, so it’s worth checking if this applies to you. Depending on your auto insurance provider, you may be eligible to take a defensive driving course to earn a safe driver insurance discount. So how much does taking a defensive driving course lower your insurance rates? Completing a defensive driving course can lead to substantial financial benefits. How much can you save with a defensive driving insurance discount? Although some insurance providers offer a defensive driving discount, most reserve this discount for older drivers.this discount varies by provider but typically ranges from 5% to 10%. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. Completing an approved defensive driving course typically results in a car insurance discount that lasts for three years. How much does the illinois traffic school defensive driving course cost? Both online defensive driving course and classroom traffic school will generally cover topics including: Still, it is important to note that not every driver is eligible for a defensive driving discount. A 10% discount for $105 is $14 off, so your new rate is $91. Completing a defensive driving course can help you save on auto insurance if your insurer offers a defensive driver discount. Still, it is important to note that not every driver is eligible for a defensive driving discount. With over 26 million drivers enrolled. The courses usually. Still, it is important to note that not every driver is eligible for a defensive driving discount. The course is eight hours and may be taken in segments. But generally, if an insurer offers a discount, it’s between 5% and 20%, and typically lasts three to five years. We work closely with major insurance providers to ensure our course meets. Learn how to get a defensive driver auto insurance discount of up to 10%, potentially saving you $36/mo on your premiums. Discounts for defensive driving courses vary from 5%. Some companies do not offer discounts, while others may offer discounts of up to 20%. The less time you’re on the road, the lower the risk and insurers often reward that.. Discounts for defensive driving courses vary from 5%. With over 26 million drivers enrolled. While it can be harder for teens to find this discount, the benefits of a defensive driving course are worth it. In general, you can expect to pay between $20 and $50. How much can a defensive driving course lower your car insurance? Many insurance companies provide discounts to drivers who take defensive driving classes, and the discounts typically range from 5% to 20% off your car insurance premium. Upon completion, you’re given a 10% discount on your auto insurance premiums. How much can a defensive driving course lower your car insurance? Many insurance providers consider a defensive driving course to be a. We work closely with major insurance providers to ensure our course meets their criteria for discounts. You enrolled in a defensive driving course for $40. What payment options are available for the illinois traffic school course? In general, you can expect to pay between $20 and $50. Many insurance companies provide discounts to drivers who take defensive driving classes, and. With over 26 million drivers enrolled. Drivers can typically save between 5% and 20% on their car insurance rates with a defensive driving course discount. How much does the illinois traffic school defensive driving course cost? The course is eight hours and may be taken in segments. Some companies do not offer discounts, while others may offer discounts of up. Will i get an insurance discount after taking the illinois traffic school course? Defensive driving discounts offered by insurance companies can vary significantly. Discounts for defensive driving courses vary from 5%. You should also want this for yourself. Some states require insurance companies to offer a discount for taking a defensive driving course, but every state has different rules. How much does the illinois traffic school defensive driving course cost? Defensive driving discounts offered by insurance companies can vary significantly. The actual amount of the discount will vary based on your insurer, age, state, and other factors. While it can be harder for teens to find this discount, the benefits of a defensive driving course are worth it. Completing. Many insurance providers consider a defensive driving course to be a driver safety course, and taking them can give you savings ranging from 5% to 20% off your annual auto insurance cost. Once you have completed the course, you should receive a discount between 5% and 15%, which lasts for three years with most insurers. The average cost of car. Completing a defensive driving course can lead to substantial financial benefits. The courses usually take four to eight hours throughout an afternoon or weekend, and they cover safety information, driving techniques and local driving laws. The course is eight hours and may be taken in segments. So how much does taking a defensive driving course lower your insurance rates? As a safe driver, you could enjoy a discount on your auto insurance policy through farmers insurance when you complete an online defensive driving course. How much can a defensive driving course lower your car insurance? Once you have completed the course, you should receive a discount between 5% and 15%, which lasts for three years with most insurers. Completing an approved defensive driving course typically results in a car insurance discount that lasts for three years. What payment options are available for the illinois traffic school course? Learn about essential defensive driving techniques, how they mitigate risks, and the direct impact on your rates. A defensive driving course typically lasts six to eight hours. Completing a defensive driving course can help you save on auto insurance if your insurer offers a defensive driver discount. You enrolled in a defensive driving course for $40. Still, it is important to note that not every driver is eligible for a defensive driving discount. Will i get an insurance discount after taking the illinois traffic school course? Defensive driving discounts offered by insurance companies can vary significantly.Defensive Driving Course Remedial Improved Driving Program

How Much Does a Defensive Driving Course Save on Insurance?

Does Taking a Defensive Driving Course Lower Insurance?

Can Defensive Driving Training Lower Your Car Insurance

Cost of Defensive Driving Classes What to Expect The Wiser Driver

Cost of Defensive Driving Classes What to Expect The Wiser Driver

Defensive Driving Course for Automobile Insurance Reduction/Point

Senior Defensive Driving Course Save Money on Car Insurance Lake

Are Defensive Driving Courses Worth the Money? QuoteWizard

Does a defensive driving course lower your insurance costs?

Please Contact Your Insurance Provider For More Information And To Check If A Discount Applies To You.

Many Insurance Companies Provide Discounts To Drivers Who Take Defensive Driving Classes, And The Discounts Typically Range From 5% To 20% Off Your Car Insurance Premium.

Most Often, Drivers Can Expect A Discount Of About 10%.

The Average Cost Of Car Insurance In Texas After One Dwi Is $3,246, An Increase Of $1,203.Multiple Dwis Come With Increased Penalties And Much Higher Car Insurance Rates For Years.

Related Post: