Holder And Holder In Due Course

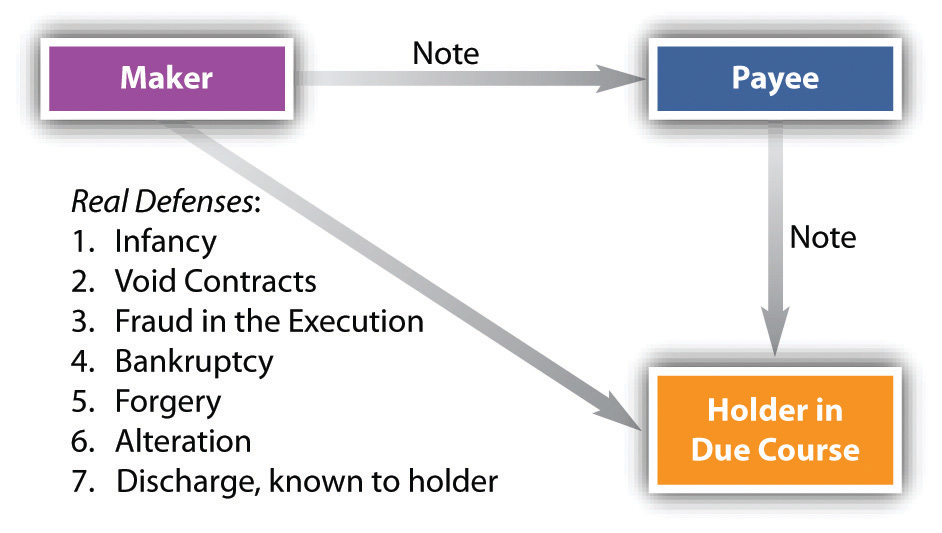

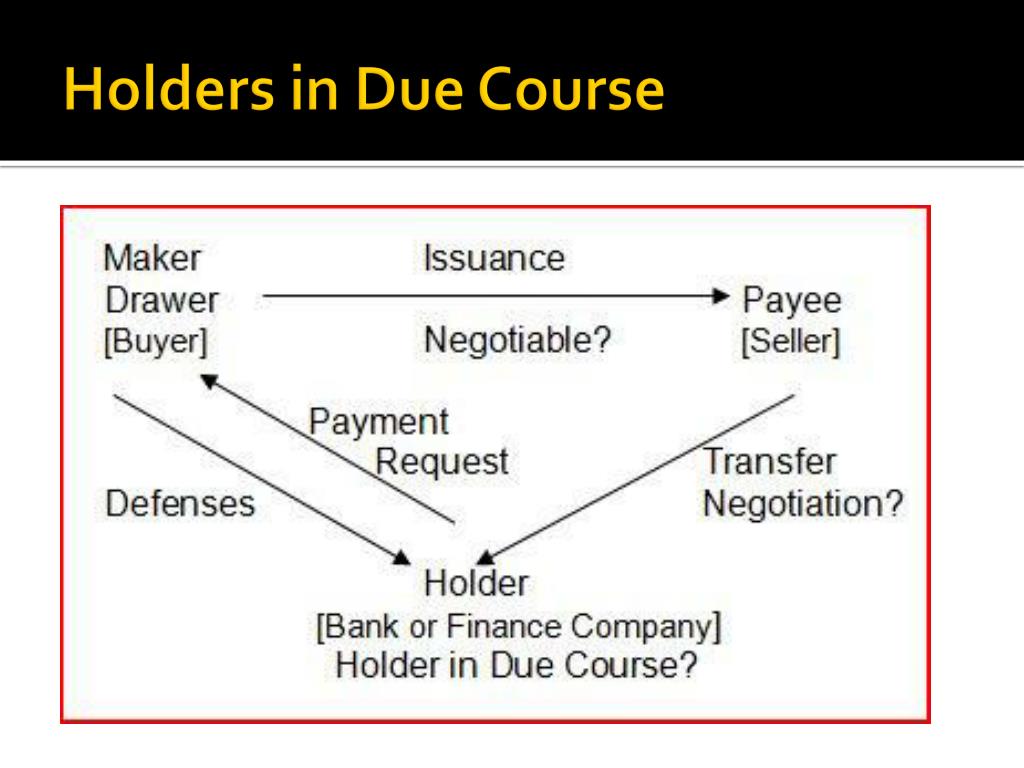

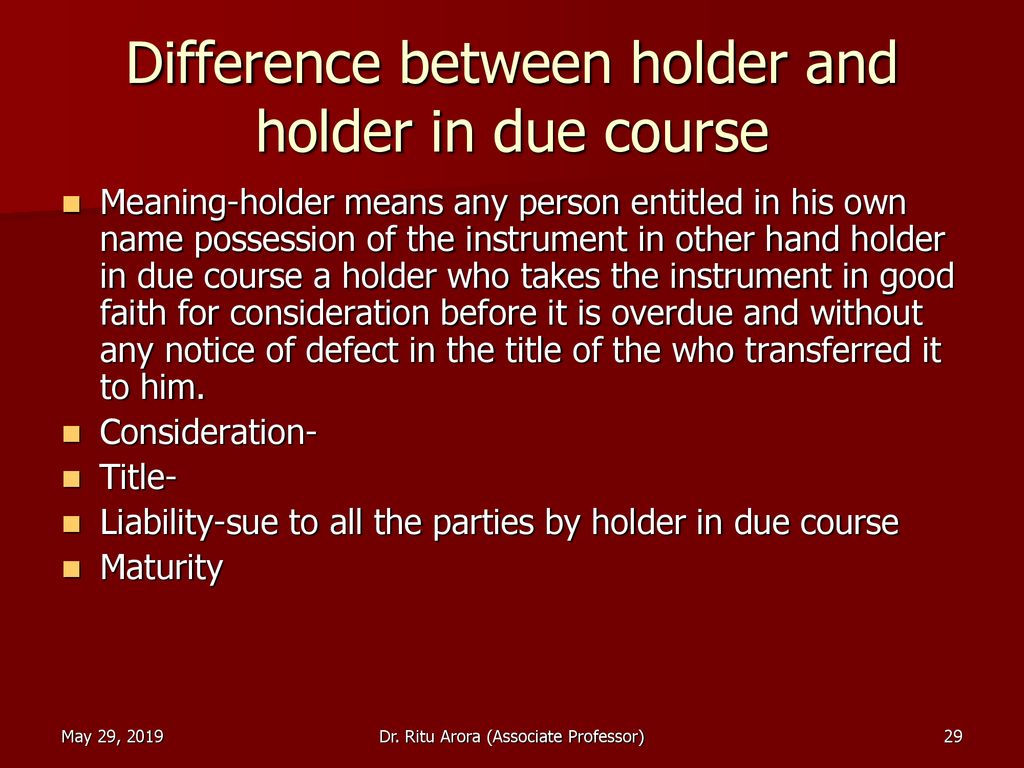

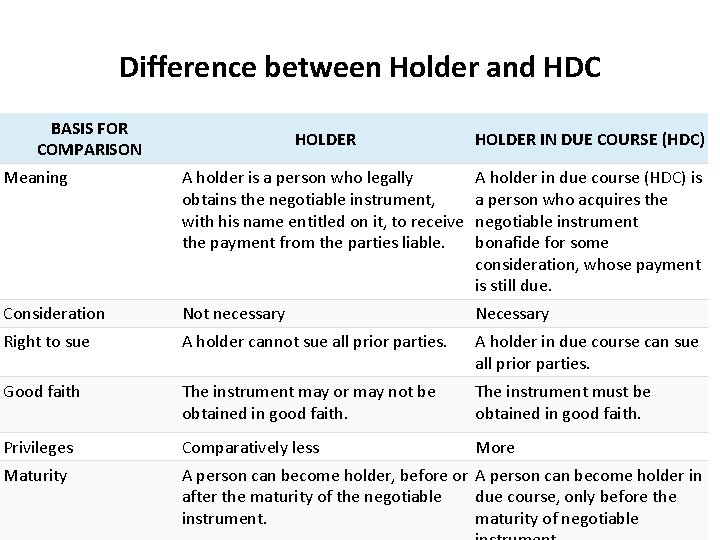

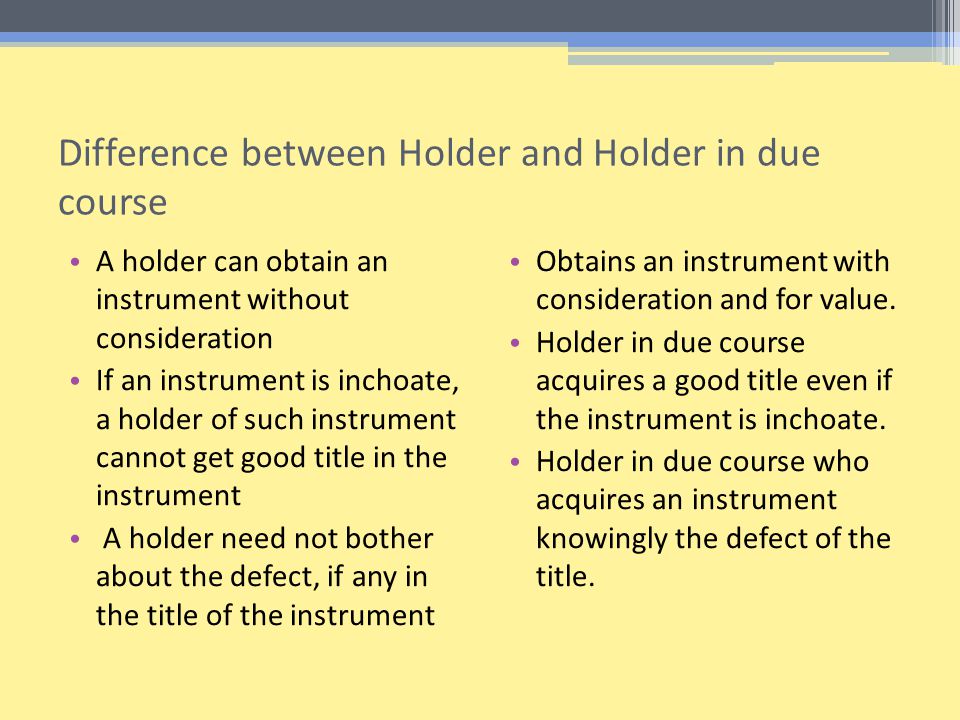

Holder And Holder In Due Course - A holder is a payee who can sue the parties liable, while a holder in due course is a bonafide possessor who can sue all prior parties. Holder in due course and privileges: Understanding the difference between holder and holder in due course is essential for legal professionals, businesses, and individuals dealing with negotiable instruments to. Explore key requirements and legal protections under the ucc. A holder possesses a negotiable instrument with the right to enforce it, while a holder in due course acquires it in good faith, without defects, and holds superior rights. Learn about the holder in due course concept, its rules, examples, and real estate applications. Who is a holder in due course? Holder in due course refers to the. We mean the payee of the negotiable instrument, who is in possession of it. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. Learn the meaning and comparison of holder and holder in due course, two terms related to negotiable instruments. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; A holder in due course (hdc) is someone who takes a negotiable instrument without reason to doubt its payment. Section 9 of the act defines ‘holder in due course’ as any person who (i) for valuable consideration, (ii) becomes the possessor of a. Holder in due course must obtain the instrument in good faith. In contrast, a holder in due course, or hdc, refers to someone who acquires the instrument in good faith, for value, and before its maturity date, without knowledge of any defects in the. Explore key requirements and legal protections under the ucc. A holder in due course obtains the negotiable instrument in good faith for consideration prior to it becomes due for payment. We mean the payee of the negotiable instrument, who is in possession of it. A holder possesses a negotiable instrument with the right to enforce it, while a holder in due course acquires it in good faith, without defects, and holds superior rights. Holder in due course can be termed as a person who acquires a negotiable instrument for consideration in good faith before it becomes due for payment and without having knowledge. Holder in due course and privileges: Explore key requirements and legal protections under the ucc. In contrast, a holder in due course, or hdc, refers to someone who acquires the. A holder in due course obtains the negotiable instrument in good faith for consideration prior to it becomes due for payment. This is the basic difference between the holder and holder in due course. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any. Holder is a person who is entitled for the possession of a negotiable instrument in his own name. Holder in due course refers to the. We mean the payee of the negotiable instrument, who is in possession of it. Holder in due course and privileges: Learn about the rights, limitations and history of this concept in commercial. A holder in due course obtains the negotiable instrument in good faith for consideration prior to it becomes due for payment. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. In contrast, a holder in due course, or hdc, refers. This is the basic difference between the holder and holder in due course. Holder in due course must obtain the instrument in good faith. Holder refers to a person; In contrast, a holder in due course, or hdc, refers to someone who acquires the instrument in good faith, for value, and before its maturity date, without knowledge of any defects. A holder in due course (hdc) is someone who takes a negotiable instrument without reason to doubt its payment. We mean the payee of the negotiable instrument, who is in possession of it. In contrast, a holder in due course, or hdc, refers to someone who acquires the instrument in good faith, for value, and before its maturity date, without. Learn about the holder in due course concept, its rules, examples, and real estate applications. A holder is a payee who can sue the parties liable, while a holder in due course is a bonafide possessor who can sue all prior parties. Who is a holder in due course? A holder possesses a negotiable instrument with the right to enforce. S/he is someone who is entitled to receive or recover the amount due on the instrument. A holder in due course obtains the negotiable instrument in good faith for consideration prior to it becomes due for payment. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without. Holder in due course can be termed as a person who acquires a negotiable instrument for consideration in good faith before it becomes due for payment and without having knowledge. Hence he shall receive or recover the amount due thereon. Section 9 of the act defines ‘holder in due course’ as any person who (i) for valuable consideration, (ii) becomes. We mean the payee of the negotiable instrument, who is in possession of it. A holder in due course is any person who receives or holds a negotiable instrument such as a check or promissory note in good faith and in exchange for value; Holder refers to a person; Holder is a person who is entitled for the possession of. Holder is a person who is entitled for the possession of a negotiable instrument in his own name. Holder in due course and privileges: Hence he shall receive or recover the amount due thereon. Explore key requirements and legal protections under the ucc. S/he is someone who is entitled to receive or recover the amount due on the instrument. Under ucc article 3, a holder in due course is someone who acquires a negotiable instrument in good faith, for value, and without notice of any defects or claims. A holder is a payee who can sue the parties liable, while a holder in due course is a bonafide possessor who can sue all prior parties. A holder possesses a negotiable instrument with the right to enforce it, while a holder in due course acquires it in good faith, without defects, and holds superior rights. Holder in due course refers to the. A holder in due course (hdc) is someone who takes a negotiable instrument without reason to doubt its payment. Section 9 of the act defines ‘holder in due course’ as any person who (i) for valuable consideration, (ii) becomes the possessor of a. Holder in due course must obtain the instrument in good faith. This is the basic difference between the holder and holder in due course. Holder refers to a person; Understanding the difference between holder and holder in due course is essential for legal professionals, businesses, and individuals dealing with negotiable instruments to. Holder in due course can be termed as a person who acquires a negotiable instrument for consideration in good faith before it becomes due for payment and without having knowledge.Holder in Due Course

Holder and Holder in Due Course PDF Negotiable Instrument Common Law

Holder in Due Course and Defenses

PPT Holders in Due Course PowerPoint Presentation, free download ID

Holder and Holder in Due Course PDF Negotiable Instrument Private Law

PPT Negotiable Instruments PowerPoint Presentation, free download

The Negotiable Instruments Act, ppt download

Holder and Holder in Due course Dr Manish

NEGOTIABLE INSTRUMENTS ACT ppt video online download

PPT Negotiable Instruments PowerPoint Presentation, free download

A Holder In Due Course Obtains The Negotiable Instrument In Good Faith For Consideration Prior To It Becomes Due For Payment.

We Mean The Payee Of The Negotiable Instrument, Who Is In Possession Of It.

Learn About The Rights, Limitations And History Of This Concept In Commercial.

Learn The Meaning And Comparison Of Holder And Holder In Due Course, Two Terms Related To Negotiable Instruments.

Related Post: