Financial Statement Course

Financial Statement Course - Financial statement modeling is a key step in the process of valuing companies and the securities they have issued. Understand the mechanics of financial statements. In this course, we will learn how to read and use annual reports and financial statements. The curriculum combines theoretical frameworks with. In this course, you will gain insights into how analyzing income statements, balance sheets, and cash flow statements can provide a comprehensive understanding of a company’s financial. Did you know that cash is the most liquid asset and is listed first on. Fundamentals of corporate financial statement analysis. Delivered first quarter revenue of $179 million reported net cash provided by operating activities of $34 million; It involves strategically navigating different areas of the financial world. Transform you career with coursera's online financial statements courses. Participants will develop the skills to assess the value of assets, analyze financial statements, and make strategic investment decisions. The curriculum combines theoretical frameworks with. The goal of the course is to. Financial statement analysis involves a detailed evaluation of a company’s three primary financial reports: From debits and credits to advanced financial statement analysis. Live online programsshort programsivy league facultycertificate path Expansive info resourcesfinancial analysis toolsbetter, faster decisions Fundamentals of corporate financial statement analysis. The income statement (also known as the profit & loss or p&l. Explain the broader purpose of financial statements and the role of accounting in producing financial statements. Navigate common sec filings and search for information. Delivered first quarter revenue of $179 million reported net cash provided by operating activities of $34 million; Understand the mechanics of financial statements. The curriculum combines theoretical frameworks with. Free cash flow of $25 million welcomed a first quarter. Live online programsshort programsivy league facultycertificate path Expansive info resourcesfinancial analysis toolsbetter, faster decisions This course is designed to prepare students to interpret and analyze financial statements for tasks such as credit and security analyses, lending and investment decisions,. The income statement (also known as the profit & loss or p&l. Fundamentals of corporate financial statement analysis. Financial statement modeling is a key step in the process of valuing companies and the securities they have issued. Participants will develop the skills to assess the value of assets, analyze financial statements, and make strategic investment decisions. Mastering finance is more than just crunching numbers; Did you know that cash is the most liquid asset and is listed first. Navigate common sec filings and search for information. Financial statement modeling is a key step in the process of valuing companies and the securities they have issued. Mastering finance is more than just crunching numbers; These courses will be used to calculate the major grade point average, which must be at least 2.0. Understand the system of preparing financial statements,. It involves strategically navigating different areas of the financial world. From engaging in venture capital ventures and. In this course, you will gain insights into how analyzing income statements, balance sheets, and cash flow statements can provide a comprehensive understanding of a company’s financial. The income statement (also known as the profit & loss or p&l. Expansive info resourcesfinancial analysis. The curriculum combines theoretical frameworks with. Understand the mechanics of financial statements. Participants will develop the skills to assess the value of assets, analyze financial statements, and make strategic investment decisions. Mastering finance is more than just crunching numbers; Understand the system of preparing financial statements, gain. Did you know that cash is the most liquid asset and is listed first on. Navigate common sec filings and search for information. It involves strategically navigating different areas of the financial world. Understand the mechanics of financial statements. The curriculum combines theoretical frameworks with. The curriculum combines theoretical frameworks with. From engaging in venture capital ventures and. Calculate and understand the drivers of common return. Highlight the unique information found in each of the five financial statements. Mastering finance is more than just crunching numbers; Navigate common sec filings and search for information. Successfully navigate through an annual report and recognize its various components. Transform you career with coursera's online financial statements courses. This course is designed to prepare students to interpret and analyze financial statements for tasks such as credit and security analyses, lending and investment decisions,. Financial statement analysis involves a detailed evaluation. You’ll learn to understand and interpret corporate financial statements in this foundational course of our accounting curriculum. This course is designed to prepare students to interpret and analyze financial statements for tasks such as credit and security analyses, lending and investment decisions,. In an era where internal controls are no longer sufficient to deter determined fraudsters, understanding financial statement fraud. Deepen your knowledge of basic principles and the concepts. Successfully navigate through an annual report and recognize its various components. From engaging in venture capital ventures and. By touring a real company and interviewing real business people, the course describes the basic content of financial statements in a simple yet relevant context. Mastering finance is more than just crunching numbers; In this course, you will gain insights into how analyzing income statements, balance sheets, and cash flow statements can provide a comprehensive understanding of a company’s financial. This course is designed to prepare students to interpret and analyze financial statements for tasks such as credit and security analyses, lending and investment decisions,. Understand the mechanics of financial statements. Includes case studies w/ excel examples. These courses will be used to calculate the major grade point average, which must be at least 2.0. From debits and credits to advanced financial statement analysis. Financial statement analysis involves a detailed evaluation of a company’s three primary financial reports: We begin our discussion with an overview of developing a revenue forecast. Up to 10% cash back financial ratio and financial statement analysis tools for value investors! Explain the broader purpose of financial statements and the role of accounting in producing financial statements. Expansive info resourcesfinancial analysis toolsbetter, faster decisionsFinancial Statement Analysis Standard Course Outline

Free Accounting Course Financial Accounting Courses Online

CFT's Analyzing Financial Statements Course by FlexLearn Center for

How to Read Financial Statements Free Accounting Courses

Financial Statement Modeling Course Overview Wall Street Oasis

How to Read Financial Statements Free Accounting Courses

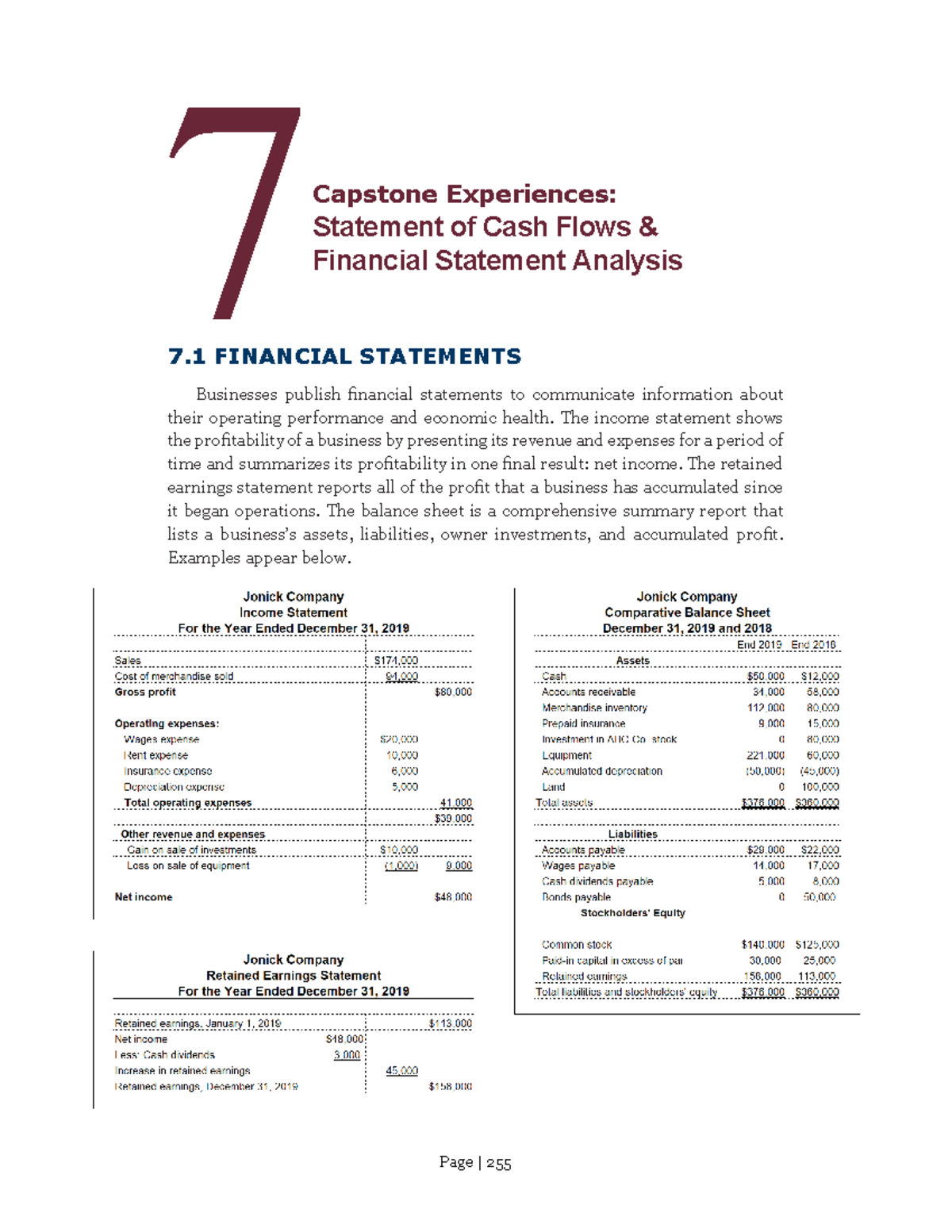

Accountant Financial Statement 7 FINANCIAL STATEMENTS

Free Financial Analyst Courses Online 2021

Financial Analysis Tutorchrome

Financial Statement Analysis Management Sciences Course Outline

In An Era Where Internal Controls Are No Longer Sufficient To Deter Determined Fraudsters, Understanding Financial Statement Fraud (Fsf) Has Never Been More Critical.

The Curriculum Combines Theoretical Frameworks With.

Delivered First Quarter Revenue Of $179 Million Reported Net Cash Provided By Operating Activities Of $34 Million;

Calculate And Understand The Drivers Of Common Return.

Related Post: