Cpe Ethics Course

Cpe Ethics Course - These requirements stipulate that you must complete at least 120 hours of acceptable continuing professional. Adhering to the aicpa code of professional conduct; Our courses are written by nationally known authors and available in. Surgent offers a variety of courses to help cpas fulfill their ethics cpe credit requirements, including courses on ethics for cpas, professional conduct, regulatory ethics, and ethical. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits Online cpe ethics courses and webinars. Fulfill your cpa ethics requirements with our classes. Cpe think offers online ethics courses tailored to the upkeep of standards in professional conduct. Other professional accountancy bodies have also emphasised the importance of ethics training by requiring cpe hours in ethics as a mandatory component of their continuing. Ethics cpe courses for cpas that are state approved to help you meet your state specific cpe ethics requirements. Our courses are written by nationally known authors and available in. Ai presents an ethical challenge to the cpa practitioner taking cpe. The american institute of certified public accountants' comprehensive course (for licensure) Viewing and analyzing ethical matters; When it comes to pursuing cpe ethics, two options have emerged as the most popular ones: All cpas must meet the illinois cpe requirements to maintain their license. Ethics cpe courses for cpas that are state approved to help you meet your state specific cpe ethics requirements. Nasba approved aicpa 2 hours ethics course for cpas. We offer a wide range of cpe ethics courses online that address timely ethics topics, such as maintaining integrity in the. As accounting rules continue to evolve and become more challenging to the cpe student, there is temptation. Viewing and analyzing ethical matters; Online cpe ethics courses and webinars. Ethics cpe courses for cpas that are state approved to help you meet your state specific cpe ethics requirements. These requirements stipulate that you must complete at least 120 hours of acceptable continuing professional. Our courses are written by nationally known authors and available in. Becker helps accountants tackle cpe requirements. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits As accounting rules continue to evolve and become more challenging to the cpe student, there is temptation. Nasba approved aicpa 2 hours ethics course for cpas. Most dates and timeslive or webcastindustry expertsregister today All cpas must meet the illinois cpe requirements to maintain their license. We offer a wide range of cpe ethics courses online that address timely ethics topics, such as maintaining integrity in the. Four of the 120 hours must be. When it comes to pursuing cpe ethics, two options have emerged as the most popular ones: Adhering to the aicpa. All cpas must meet the illinois cpe requirements to maintain their license. Nasba approved aicpa 2 hours ethics course for cpas. Pass guaranteepremium live classeslive online instruction Our cpe ethics courses have all the information you need to meet. Other professional accountancy bodies have also emphasised the importance of ethics training by requiring cpe hours in ethics as a mandatory. Four of the 120 hours must be. Online cpe ethics courses and webinars. Nasba approved aicpa 2 hours ethics course for cpas. Ethics cpe courses for cpas that are state approved to help you meet your state specific cpe ethics requirements. Adhering to the aicpa code of professional conduct; Our cpe ethics courses have all the information you need to meet. Surgent offers a variety of courses to help cpas fulfill their ethics cpe credit requirements, including courses on ethics for cpas, professional conduct, regulatory ethics, and ethical. Pass guaranteepremium live classeslive online instruction Other professional accountancy bodies have also emphasised the importance of ethics training by requiring cpe. Four of the 120 hours must be. The american institute of certified public accountants' comprehensive course (for licensure) Becker helps accountants tackle cpe requirements. Other professional accountancy bodies have also emphasised the importance of ethics training by requiring cpe hours in ethics as a mandatory component of their continuing. Ai presents an ethical challenge to the cpa practitioner taking cpe. Online cpe ethics courses and webinars. Cpe credits for cpascpe credits for easwebinars & seminarsunlimited cpe credits Surgent offers a variety of courses to help cpas fulfill their ethics cpe credit requirements, including courses on ethics for cpas, professional conduct, regulatory ethics, and ethical. When it comes to pursuing cpe ethics, two options have emerged as the most popular ones:. As accounting rules continue to evolve and become more challenging to the cpe student, there is temptation. Ethics cpe courses for cpas that are state approved to help you meet your state specific cpe ethics requirements. Our courses are written by nationally known authors and available in. Our cpe ethics courses have all the information you need to meet. Other. As accounting rules continue to evolve and become more challenging to the cpe student, there is temptation. Becker helps accountants tackle cpe requirements. Surgent offers a variety of courses to help cpas fulfill their ethics cpe credit requirements, including courses on ethics for cpas, professional conduct, regulatory ethics, and ethical. Four of the 120 hours must be. The american institute. Nasba approved aicpa 2 hours ethics course for cpas. Adhering to the aicpa code of professional conduct; When it comes to pursuing cpe ethics, two options have emerged as the most popular ones: Our courses are written by nationally known authors and available in. Becker helps accountants tackle cpe requirements. Cpe think offers online ethics courses tailored to the upkeep of standards in professional conduct. Viewing and analyzing ethical matters; As accounting rules continue to evolve and become more challenging to the cpe student, there is temptation. Other professional accountancy bodies have also emphasised the importance of ethics training by requiring cpe hours in ethics as a mandatory component of their continuing. Applying the code’s conceptual framework; Ai presents an ethical challenge to the cpa practitioner taking cpe. Online cpe ethics courses and webinars. Ethics cpe courses for cpas that are state approved to help you meet your state specific cpe ethics requirements. Ethics cpe courses for cpas that are state approved to help you meet your state specific cpe ethics requirements. On this page, we’ll discuss all the essential things related to illinois cpe requirements for cpa together with which illinois cpe courses you should choose and several other things. While choosing between these ultimately comes.CPE Ethics Courses from YouTube

Explore NASBAApproved CPE Ethics Courses by CPE Credit Professional

General Ethics CPE Courses for CPAs CPE Think

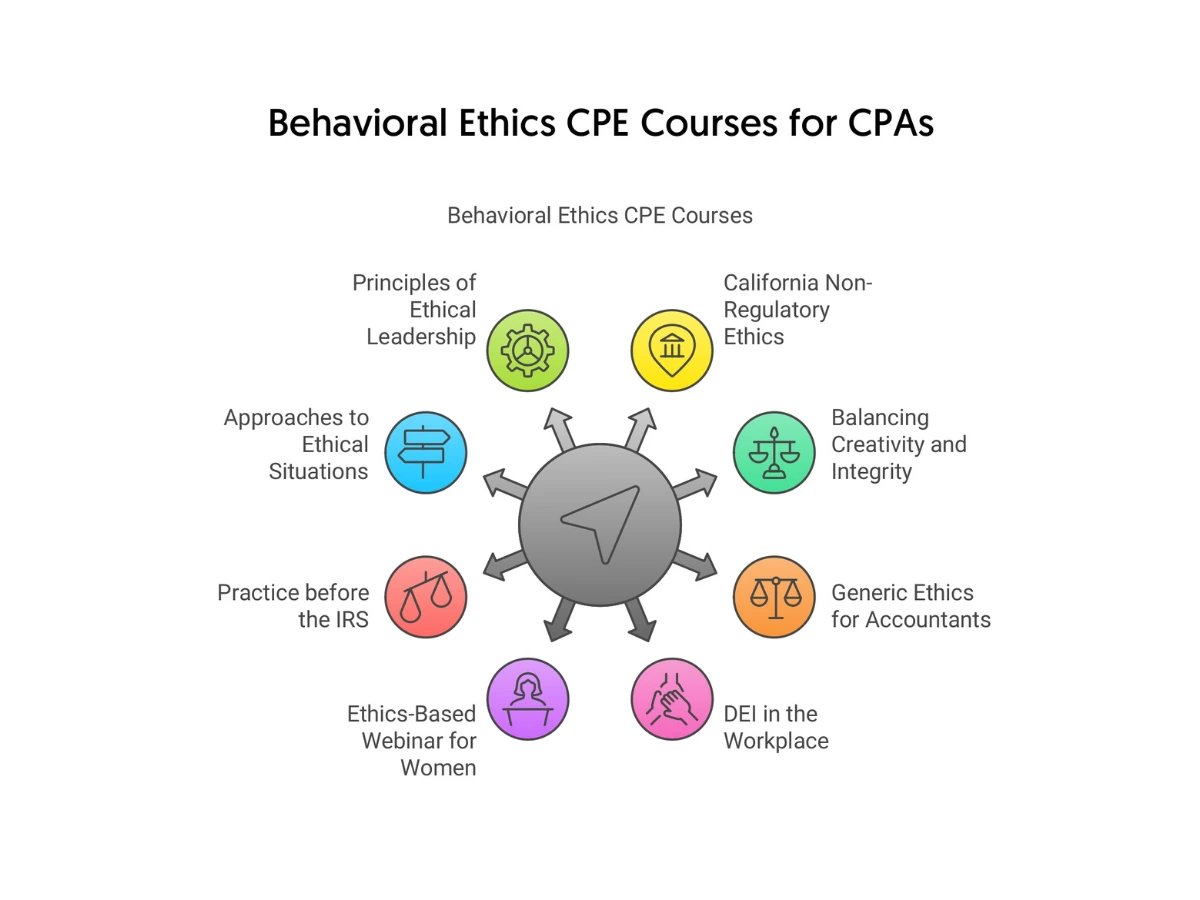

Behavioral Ethics CPE Courses for CPAs Online CPEThink

Professional CPE/CPD & Ethics Course for Renewal of Professional

Ethics Courses Online Learning for Moral Values CPE World

AICPA Ethics 3 hr Online CPE Course • JN CPE Courses

Accounting Ethics Ethics for CPA CPE The CPE Store, Inc.

Find Your Ethics CPE Credits Here! VTR Learning

Mississippi Ethics A Continuing Professional Education Ethics Course

All Cpas Must Meet The Illinois Cpe Requirements To Maintain Their License.

Our Courses Are Written By Nationally Known Authors And Available In.

These Requirements Stipulate That You Must Complete At Least 120 Hours Of Acceptable Continuing Professional.

Four Of The 120 Hours Must Be.

Related Post: