Corporate Income Tax Course

Corporate Income Tax Course - You will learn how to calculate corporate income tax liability and compute the corporate alternative minimum tax (amt). These seven tax cpe courses focus on tax compliance and topics including preparing form 1065, s. Identify how corporate contribution and distribution transactions are taxed, under the internal revenue code and interpretative authorities (including regulations and case law). Over 200 programsfree introductory periodpublic & nonprofitrequest information While house price growth is expected to slow further, towards 1 to 1.5%, we're still on course for a 5% uplift in sales volumes in 2025, assuming sellers remain pragmatic on. Study anywhere, anytime, at your own pace with our advanced tax course. National tax training school was founded in 1952 and over the past 60+ years has grown into the most recognized and respected distance learning institution dedicated to training its. An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return. Embark on a journey to become an expert in entity taxation. Chat support available11 million+ servedask live. Start for free today and take your skills to the next level. For example, advanced corporate tax, a required course for the corporate certificate, is not usually offered online. Gain the confidence and skills needed to address. Over 200 programsfree introductory periodpublic & nonprofitrequest information Find courses and certifications from top universities and companies. You will learn how to calculate corporate income tax liability and compute the corporate alternative minimum tax (amt). Launch become a tax preparer. This course provides participants with an understanding of the principles and limitations of corporate income taxes. Up to 10% cash back learn the meaning of corporate tax planning and its concept, different types of the tax strategies. Identify how corporate contribution and distribution transactions are taxed, under the internal revenue code and interpretative authorities (including regulations and case law). This course provides participants with an understanding of the principles and limitations of corporate income taxes. And to say that americans pay tax on treasury interest but chinese or french or german or u.k. Launch become a tax preparer. While house price growth is expected to slow further, towards 1 to 1.5%, we're still on course for a 5% uplift. National tax training school was founded in 1952 and over the past 60+ years has grown into the most recognized and respected distance learning institution dedicated to training its. Students who want to learn to complete tax returns can enroll in one of our three tax preparation courses: Up to 10% cash back learn the meaning of corporate tax planning. Students may suggest a substitute tax class for approval (or ask for a. Identify how corporate contribution and distribution transactions are taxed, under the internal revenue code and interpretative authorities (including regulations and case law). Chat online.40+ years of success This course provides participants with an understanding of the principles and limitations of corporate income taxes. And to say that. Students may suggest a substitute tax class for approval (or ask for a. Identify how corporate contribution and distribution transactions are taxed, under the internal revenue code and interpretative authorities (including regulations and case law). Explore the free tax courses available on coursera. If the credit reduces your tax to less than zero, you may get a refund. You'll be. This course provides participants with an understanding of the principles and limitations of corporate income taxes. Embark on a journey to become an expert in entity taxation. Identify how corporate contribution and distribution transactions are taxed, under the internal revenue code and interpretative authorities (including regulations and case law). You will learn how to calculate corporate income tax liability and. Chat online.40+ years of success This course provides participants with an understanding of the principles and limitations of corporate income taxes. The university of cincinnati online’s certificate in corporate taxation focuses on a range of issues revolving around tax compliance for corporations. You will learn how to calculate corporate income tax liability and compute the corporate alternative minimum tax (amt).. An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return. Chat support available11 million+ servedask live. You will learn how to calculate corporate income tax liability and compute the corporate alternative minimum tax (amt). Study anywhere, anytime, at your own pace with our advanced tax course. And to say. Identify how corporate contribution and distribution transactions are taxed, under the internal revenue code and interpretative authorities (including regulations and case law). These include the basics of tax law, tax planning, and compliance. If the credit reduces your tax to less than zero, you may get a refund. Chat support available11 million+ servedask live. Over 200 programsfree introductory periodpublic &. Tax courses cover a variety of topics essential for understanding and managing taxation processes. National tax training school was founded in 1952 and over the past 60+ years has grown into the most recognized and respected distance learning institution dedicated to training its. Up to 10% cash back learn the meaning of corporate tax planning and its concept, different types. Explore the free tax courses available on coursera. The university of cincinnati online’s certificate in corporate taxation focuses on a range of issues revolving around tax compliance for corporations. For example, advanced corporate tax, a required course for the corporate certificate, is not usually offered online. You'll be exposed to the u.s. National tax training school was founded in 1952. For example, advanced corporate tax, a required course for the corporate certificate, is not usually offered online. Students who want to learn to complete tax returns can enroll in one of our three tax preparation courses: Gain the confidence and skills needed to address. Over 200 programsfree introductory periodpublic & nonprofitrequest information Up to 10% cash back learn the meaning of corporate tax planning and its concept, different types of the tax strategies. If the credit reduces your tax to less than zero, you may get a refund. Explore the free tax courses available on coursera. You will be able to learn about. Start for free today and take your skills to the next level. An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return. This course provides participants with an understanding of the principles and limitations of corporate income taxes. And to say that americans pay tax on treasury interest but chinese or french or german or u.k. Identify how corporate contribution and distribution transactions are taxed, under the internal revenue code and interpretative authorities (including regulations and case law). You will learn how to calculate corporate income tax liability and compute the corporate alternative minimum tax (amt). Chat support available11 million+ servedask live. Specializing federal income tax courses, irs annual filing education, tax preparation classes, and irs annual filing season programs.Business Accounting with Corporate Tax Emirates Education Centre

Introduction to Complete Corporate Liquidation Corporate Tax

How to Pass the REG CPA Exam S Corporation Corporate Tax

Section 338 Election Corporate Liquidation Corporate Tax

Free Tax Course Lecture No 13 From Business and

10 Best Tax Courses Online 2023

10 Best Tax Courses Online 2023

Top 7 Tax Certification Courses in [year] ADVISOR UNCLE

Tax Courses (2023 Updated) InstaFiling

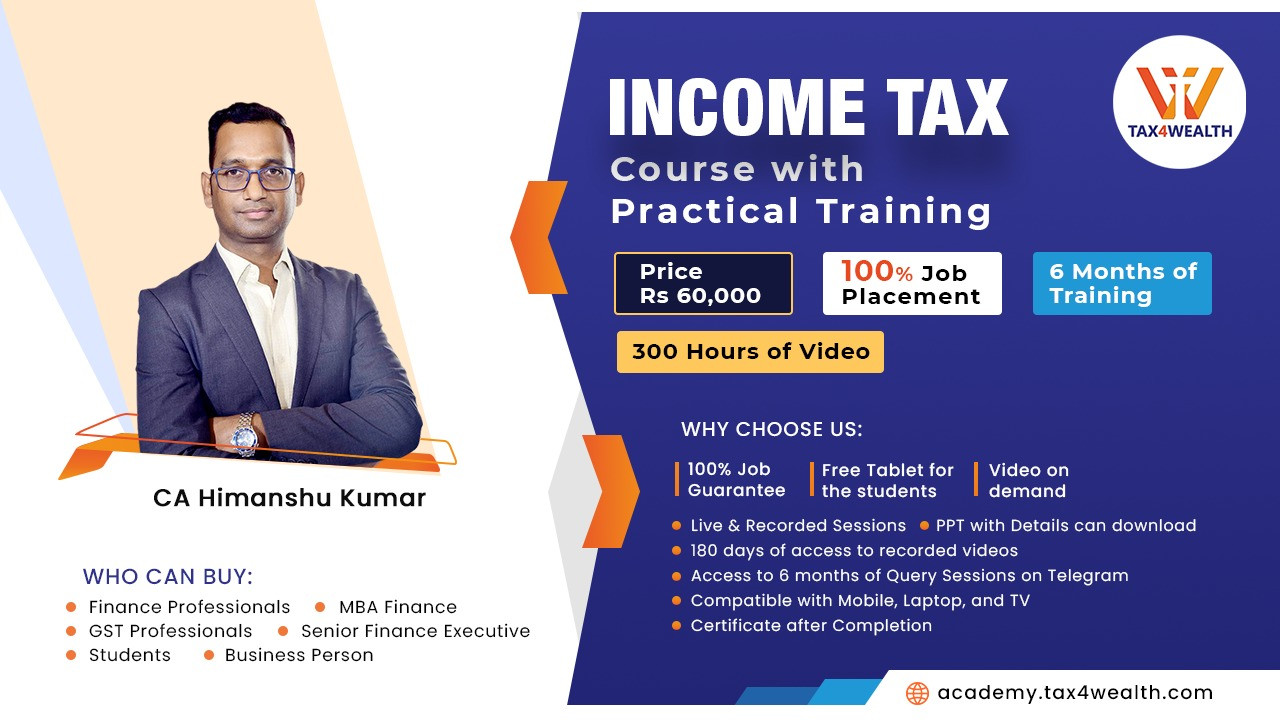

Tax Course with Practical Training Academy Tax4wealth

Students May Suggest A Substitute Tax Class For Approval (Or Ask For A.

These Seven Tax Cpe Courses Focus On Tax Compliance And Topics Including Preparing Form 1065, S.

The University Of Cincinnati Online’s Certificate In Corporate Taxation Focuses On A Range Of Issues Revolving Around Tax Compliance For Corporations.

Tax Management And Tax Evasion.

Related Post:

![Top 7 Tax Certification Courses in [year] ADVISOR UNCLE](https://advisoruncle.com/wp-content/uploads/2022/05/TOP-7-INCOME-TAX-CERTIFICATION-COURSES.png)